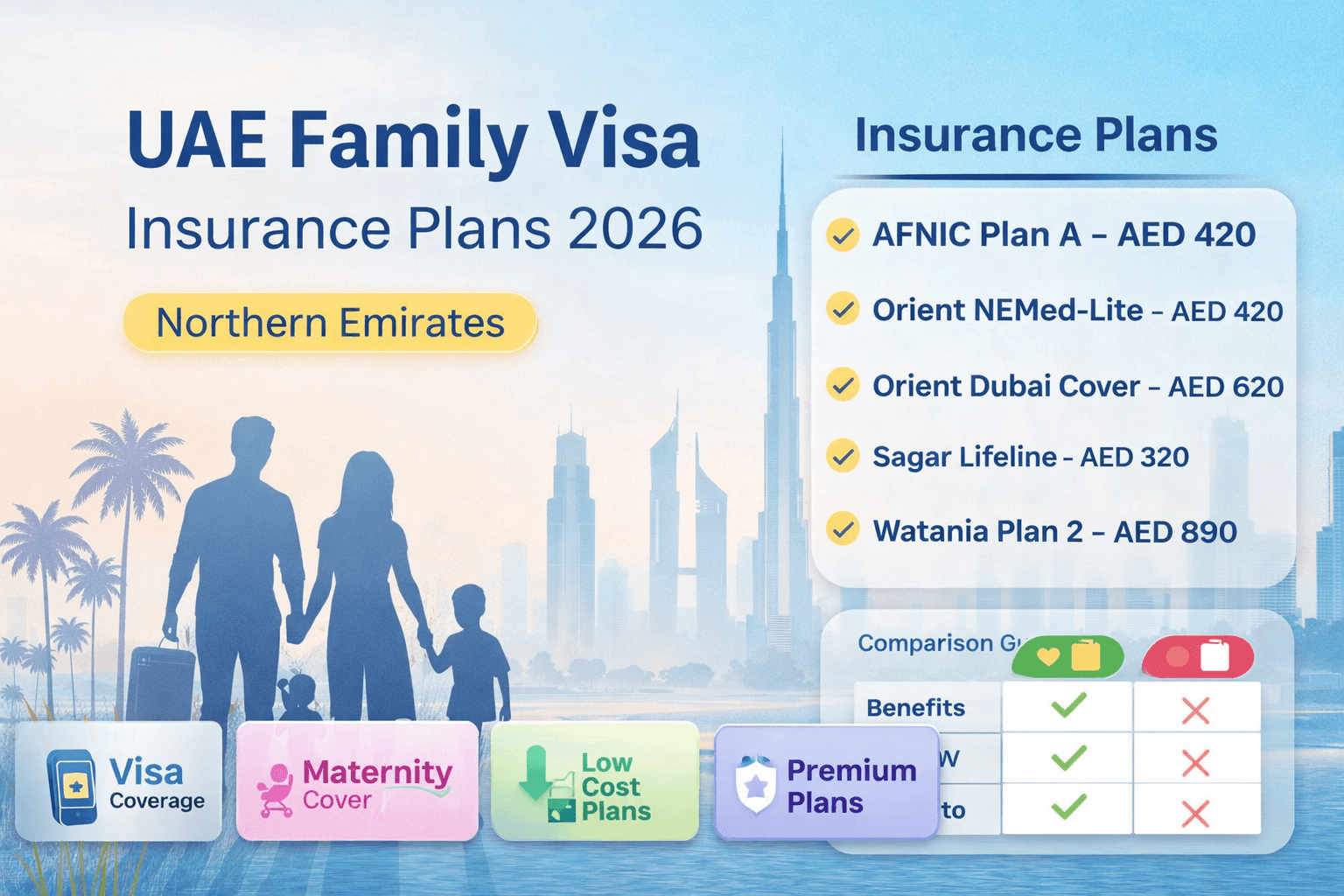

Prices, Benefits, Network List & Best Plan Comparison

When applying for a UAE family residence visa, having a valid health insurance policy is mandatory for dependents such as wife, children, and parents. Each emirate accepts only approved insurance plans, and choosing the wrong plan can lead to visa rejection or delays.

Quick Recommendation Guide

| Requirement | Best Plan |

|---|---|

| Cheapest visa insurance | AFNIC Easy Care / Sagar Lifeline |

| Best maternity (budget) | Orient NEMed-Lite |

| Best maternity (premium) | Watania Plan 2 |

| Best OP + IP balance | Orient NEMed |

| Dubai family visa | Orient Dubai Cover |

| Elderly dependents | Watania Plan 2 |

This guide explains the most popular UAE family visa insurance plans, their prices, coverage, benefits, limitations, and medical networks, helping you choose the right plan based on budget, emirate, and family needs.

Emirates Covered in This Guide

These plans are mainly valid for Northern Emirates:

- Sharjah

- Ajman

- Ras Al Khaimah

- Umm Al Quwain

- Fujairah

⚠️ Most plans below are NOT valid for Dubai or Abu Dhabi visas, unless clearly mentioned.

1. AFNIC – Plan A (AED 420)

Insurer: Al Fujairah National Insurance (AFNIC)

Network: NextCare PCP RN3

Key Benefits

- Annual limit: AED 75,000

- Inpatient limit: AED 50,000

- Outpatient limit: AED 25,000

- GP & specialist visits with coinsurance

- Emergency ambulance (UAE)

- 8 inpatient physiotherapy sessions

Limitations

- ❌ No maternity

- ❌ No pre-existing condition coverage

- ❌ No dental / optical

- ❌ Not valid for Abu Dhabi

Best For

✔ Budget family visa insurance

✔ Visa stamping & renewal only

2. AFNIC Easy Care (AED 300)

Insurer: AFNIC

Network: NextCare PCP – Northern Emirates

Key Benefits

- Annual limit: AED 40,000

- OP limit: AED 25,000

- GP/specialist consultation (fixed copay)

- Pre-existing conditions after 12 months

- Emergency inpatient coverage

Limitations

- ❌ Not valid for Dubai / Abu Dhabi

- ❌ No maternity

- ❌ Low inpatient limit (AED 15,000)

Best For

✔ Cheapest family visa insurance

✔ Northern Emirates visa only

3. AFNIC ReMedi (AED 560)

Insurer: AFNIC

Network: NextCare RN3

Key Benefits

- Annual limit: AED 75,000

- OP limit: AED 25,000

- Inpatient limit: AED 50,000

- Better OP structure than basic plans

Limitations

- ❌ No maternity

- ❌ Pre-existing conditions after waiting period

- ❌ Northern Emirates only

Best For

✔ Families needing better OP coverage

✔ Non-maternity cases

4. Aafiya ReMedi Plus – Plan A (AED 420)

Insurer: AFNIC

TPA: Aafiya (APN Network)

Key Benefits

- IP limit: AED 50,000

- OP limit: AED 10,000

- Chronic conditions after 12 months

- Balanced basic coverage

Limitations

- ❌ No maternity

- ❌ No newborn cover

- ❌ Limited OP compared to RN3 plans

Best For

✔ Budget-plus visa insurance

✔ Northern Emirates families

5. Orient Dubai Cover (AED 620)

Insurer: Orient Insurance

Key Benefits

- Valid for Dubai family visas

- Recognised Dubai network

- Higher acceptance rate for Dubai EID

Limitations

- ❌ More expensive than NE plans

- ❌ Limited maternity benefits (plan-specific)

Best For

✔ Dubai family visa applicants

6. Orient NEMed-Lite (AED 420 category)

Insurer: Orient Insurance

Network: NextCare PCP + RN3 Hospitals

Key Benefits

- Annual limit: AED 75,000

- OP limit: AED 25,000

- Maternity included

- Newborn covered for first 15 days

- 8 inpatient physiotherapy sessions

Limitations

- ❌ OP physiotherapy not covered

- ❌ Northern Emirates only

Best For

✔ Best low-cost maternity plan

✔ Families with newborn planning

7. Orient NEMed (Regular) – AED 520

Insurer: Orient Insurance

Network: NextCare PCP + RN3

Key Benefits

- Annual limit: AED 75,000

- OP limit: AED 25,000

- Maternity + newborn (15 days)

- Strong hospital network

Limitations

- ❌ No OP physiotherapy

- ❌ Not valid for Dubai / Abu Dhabi

Best For

✔ Best balanced NE family plan

✔ Maternity + wider hospital access

8. Sagar Lifeline (AED 320)

Insurer: Sagar / Lifeline

Network: Lifeline Empire

Key Benefits

- Annual limit: AED 40,000

- OP limit: AED 25,000

- India & Pakistan inpatient coverage

- Cheapest option

Limitations

- ❌ Very low inpatient limit (AED 15,000)

- ❌ No maternity

- ❌ Limited hospitals in UAE

Best For

✔ Visa stamping only

✔ Lowest-cost insurance option

9. Watania Takaful – Plan 1 (AED 750)

Insurer: Watania Takaful

Network: NAS-VN

Key Benefits

- Annual limit: AED 75,000

- OP limit: AED 25,000

- Maternity included (Thumbay Ajman)

- Higher medicine limit

Limitations

- ❌ Maternity restricted to one hospital

- ❌ No newborn cover

Best For

✔ Affordable maternity with better OP

✔ Families preferring Takaful plans

10. Watania Takaful – Plan 2 (AED 890)

Insurer: Watania Takaful

Network: NAS-VN

Key Benefits

- Annual limit: AED 150,000

- OP limit: AED 50,000

- Lowest diagnostic copay (10%)

- Strong maternity coverage

- Best premium NE plan

Limitations

- ❌ Maternity only at Thumbay Ajman

- ❌ No newborn automatic cover

Best For

✔ Premium family coverage

✔ Families planning childbirth

✔ Higher medical usage

Final Notes

- Always choose a plan matching your visa emirate

- Declare pre-existing conditions honestly

- Newborns usually need separate insurance after 15–30 days

- Cheapest plans are visa-compliance focused, not full medical protection